Example Steps for Implementing CX Surveys in E-Commerce

Where to Start?

The implementation of Customer Experience surveys should be gradual, with each step aligned to current business goals and ongoing projects.

If no experience or quality measurements have been carried out yet, the first objective of CX research should be to assess the overall condition of the e-commerce platform—examining the quality of user experience and identifying areas that require improvement.

If some research activities are already in place, we’ll evaluate the potential to use historical data and conduct a survey audit.

The foundation for implementing surveys in e-commerce should include:

Covering the E-Commerce Platform with Core CX Surveys

Implement contextual surveys across key areas of the e-commerce site, including general site experience, search functionality, cart abandonment, and post-purchase feedback.

Identify user experience (CX/UX) issues, understand visit intent, and analyze the structure of your visitor base.

Collect analytical data on the customer journey, including visits, logins, purchases, returns, and navigation paths.

The goal is to gather evaluations of the informational site experience, determine the NPS score, and analyze how these ratings relate to behavior frequency across desktop and mobile channels.

Evaluating Core Customer Journey Processes

Conduct email-based surveys focused on delivery, order pickup, returns, and complaints.

Run touchpoint-specific surveys measuring service quality and ease of contacting customer support, including personalized consultant ratings.

Research in the Physical Retail Network

E-commerce today extends beyond the website—it intersects with brick-and-mortar retail, for example through click & collect services.

Surveys in physical stores and on customer expectations regarding online–offline integration help improve omnichannel strategy and execution.

Mobile App Research (if applicable)

Collect feedback and identify issues with the mobile app based on completed actions and NPS ratings.

The goal is to analyze how user ratings correlate with the frequency of customer interactions across online and mobile channels.

CRM or System Integration

Send survey results to your CRM, or pass customer activity data from the CRM to the research platform (initially in a basic scope).

Integrate survey data with any tools already used by the Partner, such as Google Analytics.

The aim is to gain a full-context view of customer behavior—who they are and how they act.

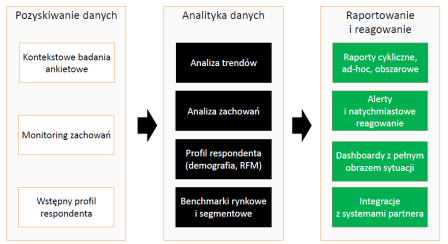

YourCX as a Central Data Hub

The YourCX platform can act as a central integrator for all insights. This includes:

Survey Results – declarative data based on respondents’ answers.

Business Events – user actions (e.g. site visit, login, contact form submission, conversation with support) collected via YourCX scripts and/or CRM integration.

Metadata – descriptive information about respondents or key business processes.

Applying these steps enables a deeper analysis of how customer experiences influence behaviors—and how those behaviors ultimately impact business outcomes.

Good to Keep in Mind:

You can start with surveys limited to the e-commerce site, but it’s important to understand that this approach will only provide insights into the CX/UX of the sales platform. It won’t capture the full customer experience across other stages of the journey—nor will it reflect the full context of the mobile channel, which continues to grow in importance.

A Few Notes on the Preparation Phase:

The scope of research and survey questionnaires are prepared by YourCX and finalized individually in consultation with the Partner.

Depending on the scale, research projects are typically implemented within 3–10 days.

Implementation on the online platform is based on embedding a tracking script that manages surveys, along with JavaScript-based tracking of key events.

Data collection should last at least 2–4 months before generating final insights.

Mobile app surveys are conducted using methods tailored to research objectives and app characteristics—for example, via push notifications or an in-app survey button.

Integration with CRM and other tools used by the Partner is configured on a case-by-case basis.

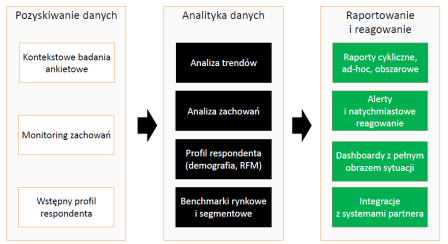

Outcome: A Unified Dataset Ready for Correlation Analysis

By combining different types of data, we can explore meaningful correlations:

Declarative data – e.g. NPS, user-reported issues

Business segments – such as customer type, age, gender, or other key characteristics

Behavioral events – including site visits, logins, conversions, retention, and repeat visits

This integrated dataset makes it possible to run correlation analyses and track behavior changes over time. For each business segment, you’ll be able to assess how specific experiences influence customer actions.